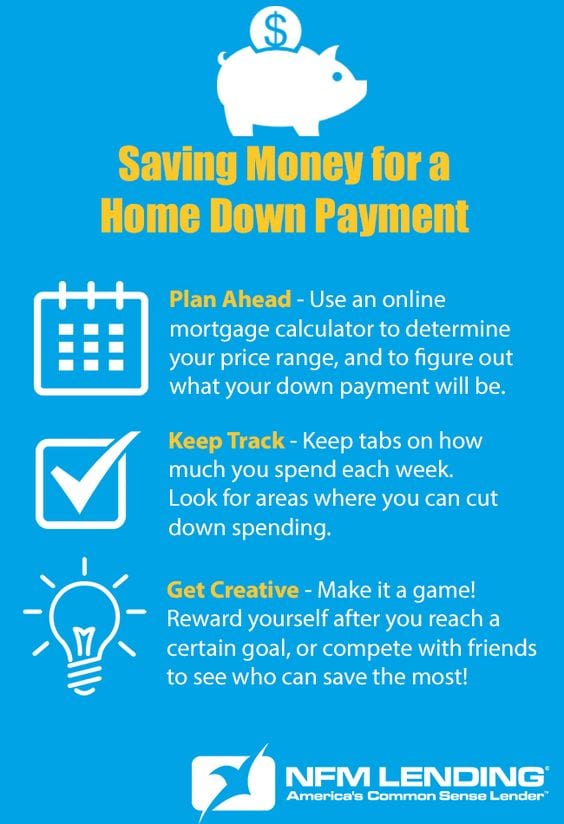

Saving for a down payment on a house requires careful planning and disciplined budgeting. Start early to reach your goal faster.

Buying a home is a significant milestone. A substantial down payment reduces your mortgage and monthly payments. Begin by setting a clear savings target based on the home’s price. Open a dedicated savings account to keep funds separate from everyday expenses.

Automate deposits to this account to ensure consistent contributions. Cut unnecessary expenses and create a budget that prioritizes saving. Explore additional income sources or side gigs to accelerate your savings. Research first-time homebuyer programs that offer grants or low-interest loans. Staying committed and focused on your goal can make the process smoother and more manageable.

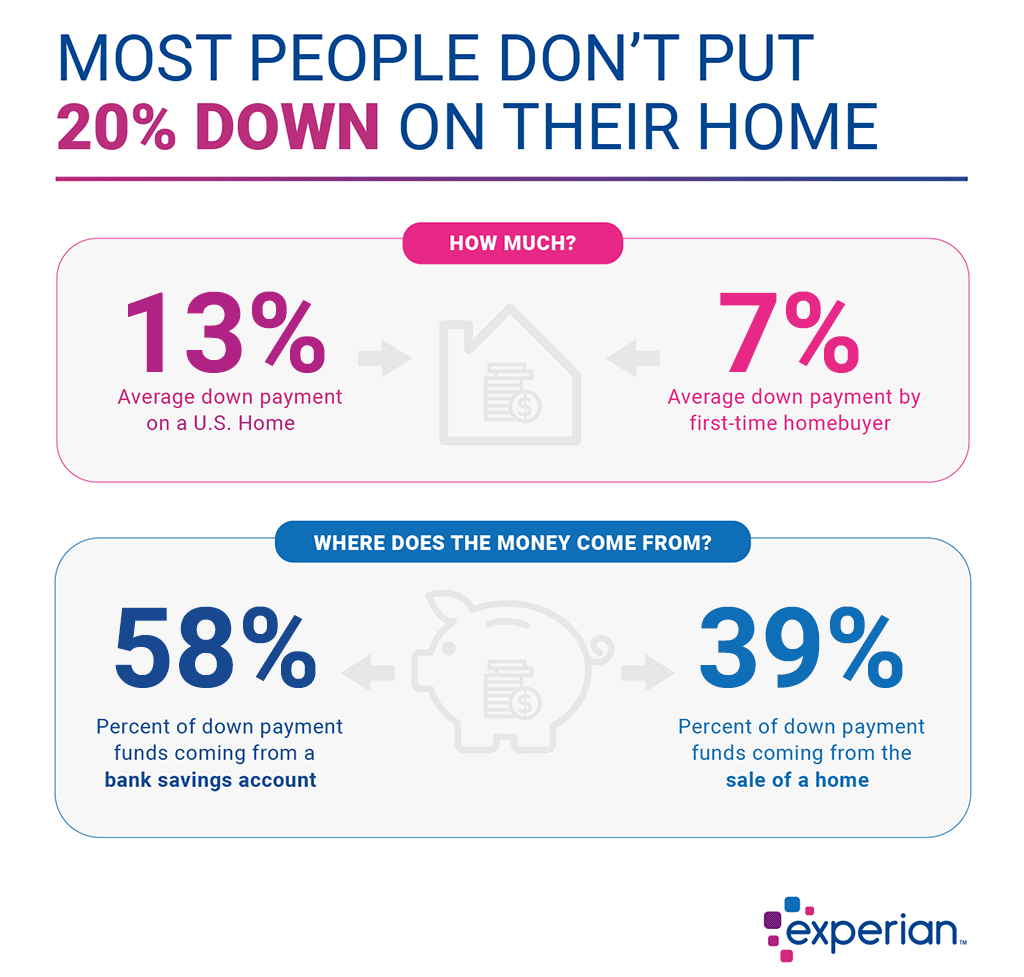

Credit: www.experian.com

Setting Clear Goals

Saving for a down payment on a house can feel overwhelming. But with clear goals, the process becomes manageable and achievable. Setting goals helps you stay focused and motivated. Let’s break down the steps to make this journey easier.

Determine Target Amount

First, you need to determine the target amount for your down payment. Typically, a down payment is 20% of the home’s price. But it can be lower or higher depending on the loan type. Here’s a quick table to help you understand:

| Home Price | 20% Down Payment | 10% Down Payment |

|---|---|---|

| $200,000 | $40,000 | $20,000 |

| $300,000 | $60,000 | $30,000 |

| $400,000 | $80,000 | $40,000 |

Knowing your target amount helps you plan better. It gives you a clear savings goal.

Set A Timeline

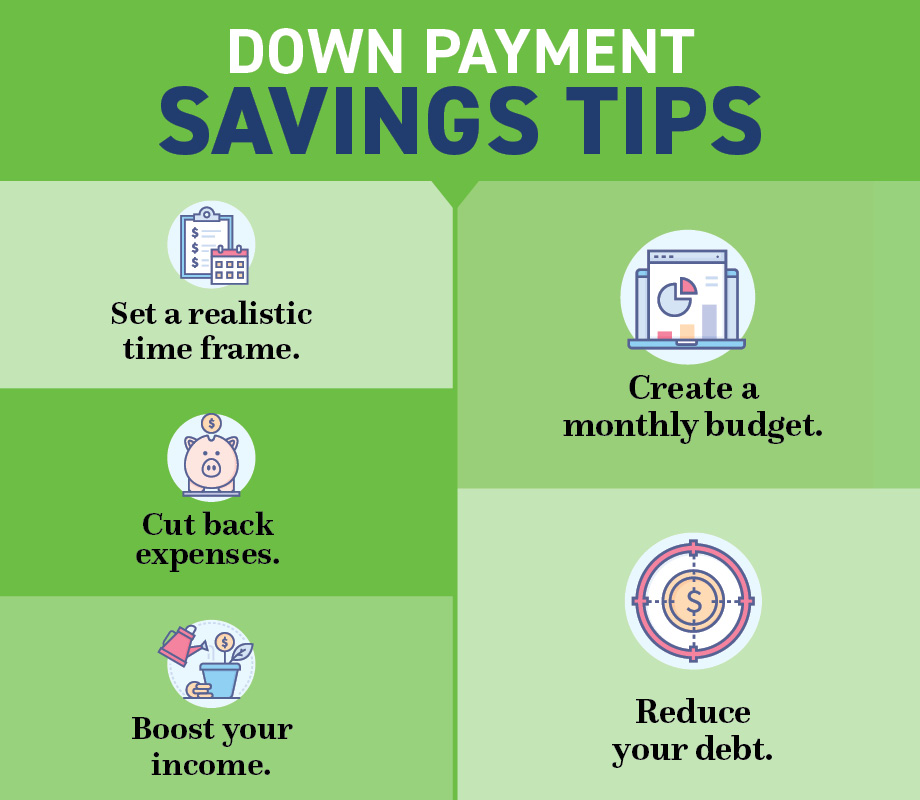

Next, you need to set a timeline for your savings goal. Having a timeline keeps you on track. Here’s how you can do it:

- Decide the number of years you want to save.

- Break down the total amount into monthly savings.

For example, if your target is $40,000 in 5 years, you need to save $667 per month. This makes your goal seem more achievable. Monthly targets are easier to manage.

Use this simple formula: Total Amount / Number of Months = Monthly Savings

Setting a timeline helps you measure progress and stay motivated.

Creating A Budget

Saving for a down payment on a house starts with creating a budget. This step helps you understand your finances and manage money better. A budget is a plan for your income and expenses. It guides you towards your savings goal.

Track Expenses

To create a budget, first track your expenses. Write down every penny you spend. This includes bills, groceries, and entertainment. Use a notebook, app, or spreadsheet. Tracking expenses helps you see where your money goes.

- Record daily expenses

- Group expenses into categories

- Review your spending weekly

Cut Unnecessary Costs

Once you track expenses, cut unnecessary costs. Identify items you can live without. This may include eating out, subscriptions, or impulse buys.

| Expense | Monthly Cost | Can You Cut? |

|---|---|---|

| Eating Out | $200 | Yes |

| Streaming Services | $30 | Yes |

| Gym Membership | $50 | No |

Cutting costs helps you save more money. Use these savings for your down payment fund. Make small changes for big savings.

Automating Savings

Saving for a down payment on a house can seem like a daunting task. One effective strategy to make this process easier is automating your savings. By leveraging technology and setting up systems, you can steadily grow your down payment fund without extra effort. Let’s explore some powerful ways to automate your savings.

Set Up Automatic Transfers

Automatic transfers can help you save consistently. They move money from your checking to your savings account on a regular schedule.

Here’s how to set it up:

- Log in to your bank account.

- Find the automatic transfer option.

- Choose the amount to transfer.

- Select the frequency (weekly, bi-weekly, or monthly).

- Confirm and save your settings.

This method ensures you save money before you spend it. Consistent savings make reaching your goal more attainable.

Use Savings Apps

Savings apps can also be a game-changer. They offer features that make saving easier and more fun.

Some popular savings apps include:

- Acorns: Rounds up your purchases and saves the change.

- Qapital: Automates savings based on your rules.

- Digit: Analyzes your spending and transfers small amounts to savings.

These apps can help you save without even noticing. They turn small habits into significant savings over time.

Automating your savings can simplify the process of saving for a down payment. By setting up automatic transfers and using savings apps, you can build your fund effortlessly.

Boosting Income

Saving for a down payment on a house can seem daunting. One effective way to speed up the process is by boosting your income. Increasing your earnings can help you save more money faster. Here are some strategies to consider.

Find Side Gigs

Side gigs can be a great way to earn extra money. You can use this additional income to save for your down payment. Here are some popular options:

- Freelancing: Offer your skills online. Websites like Upwork and Fiverr can help.

- Ridesharing: Drive for companies like Uber or Lyft. Flexible hours make it easy to fit around your schedule.

- Delivery Services: Work for services like DoorDash or Postmates. You can choose your own hours.

- Tutoring: If you excel in a subject, offer tutoring services. This can be done online or in-person.

Ask For A Raise

Another way to boost your income is by asking for a raise. This can be a straightforward way to increase your earnings without taking on extra work. Here are some tips for making your case:

- Research: Know the average salary for your position in your area.

- Document Your Achievements: Show how you have added value to the company.

- Choose the Right Time: Timing can make a big difference. Consider asking during performance reviews or after completing a successful project.

- Practice Your Pitch: Rehearse what you will say. Confidence is key.

By finding side gigs and asking for a raise, you can significantly boost your income. This will help you save for your down payment more effectively.

Utilizing Savings Accounts

Saving for a down payment on a house requires a strategic approach. Utilizing savings accounts can help you grow your money safely. These accounts offer secure ways to save and earn interest. Explore options like high-yield savings accounts and certificates of deposit.

High-yield Savings Accounts

A high-yield savings account offers higher interest rates than regular savings accounts. These accounts are a great way to grow your savings faster. Below are some benefits:

- Higher interest rates

- Low risk

- Easy access to your money

High-yield savings accounts are often offered by online banks. They can provide better rates because they have lower overhead costs. This means your money can grow more quickly. Here is a comparison table of typical interest rates:

| Account Type | Interest Rate |

|---|---|

| Regular Savings Account | 0.05% |

| High-Yield Savings Account | 1.50% – 2.00% |

Certificates Of Deposit

Certificates of Deposit (CDs) are another effective savings option. CDs offer fixed interest rates for a set term. Here are key features:

- Fixed interest rates

- Terms from 3 months to 5 years

- Higher rates than regular savings accounts

CDs are best for money you don’t need to access immediately. They offer higher interest rates due to the fixed term. You can choose the term that fits your savings goals. Below is an example of CD rates:

| Term Length | Interest Rate |

|---|---|

| 6 Months | 0.60% |

| 1 Year | 1.00% |

| 5 Years | 2.50% |

Both high-yield savings accounts and CDs offer secure ways to save. Choose the one that fits your needs and start saving for your down payment today.

Credit: nfmlending.com

Reducing Debt

Saving for a down payment on a house can be challenging. Reducing debt is key to achieving this goal. By minimizing your debt, you can save more money. This section explores effective ways to reduce debt. Focus on paying off high-interest debt and consolidating loans.

Pay Off High-interest Debt

High-interest debt can drain your finances quickly. Prioritize paying off these debts first. Here’s how you can do it:

- List all your debts with their interest rates.

- Identify the debt with the highest interest rate.

- Pay more than the minimum payment on this debt.

- Continue this process until the debt is paid off.

Paying off high-interest debt saves money in the long run. You can then use these savings for your down payment.

Consolidate Loans

Consolidating loans can simplify your debt repayment. It can also lower your interest rates. Here’s how to consolidate loans:

- Check your credit score.

- Research consolidation options like personal loans or balance transfer cards.

- Choose the option with the lowest interest rate.

- Apply for the loan or card.

- Use the new loan to pay off multiple debts.

Consolidation makes managing debt easier. It can help you save more for your down payment.

| Debt Reduction Method | Benefits |

|---|---|

| Pay Off High-Interest Debt | Reduces financial drain, saves money |

| Consolidate Loans | Simplifies repayment, lowers interest rates |

Exploring Assistance Programs

Saving for a down payment on a house can be challenging. Fortunately, there are various assistance programs available. These programs can help you achieve your dream of homeownership. Let’s explore some of these valuable resources.

First-time Homebuyer Programs

First-time homebuyer programs offer financial help. They often provide lower interest rates. Some programs even offer grants or forgivable loans.

- FHA Loans: These loans are backed by the Federal Housing Administration. They allow lower down payments and credit scores.

- VA Loans: Available to veterans and active-duty service members. These loans often require no down payment.

- USDA Loans: Designed for rural areas. They offer low-interest rates and no down payment.

Research your state’s first-time homebuyer programs. Many states offer additional benefits.

Employer Assistance

Some employers offer homebuyer assistance programs. These programs can include grants, loans, or matching funds.

| Program Type | Description |

|---|---|

| Grants | Employers provide money that doesn’t need to be repaid. |

| Loans | Low-interest or interest-free loans for down payments. |

| Matching Funds | Employers match a portion of your savings. |

Check with your HR department. They can tell you if your employer offers such programs.

Using these programs can make saving for a down payment easier. They can bring you closer to owning your home.

Staying Motivated

Saving for a down payment on a house is a big task. Staying motivated throughout the process is essential. With determination and the right strategies, you can keep your spirits high and your savings growing.

Celebrate Milestones

Break down your savings goal into smaller milestones. Each milestone reached is a victory. For example, if your goal is $20,000, celebrate when you save the first $1,000.

Reward yourself for every milestone. It can be a small treat like a favorite meal or a movie night. These rewards keep you motivated and make the journey enjoyable.

Visualize Your New Home

Take time to visualize your dream home. Picture yourself in each room, enjoying your space. This mental image can fuel your motivation.

Create a vision board with pictures of your ideal home. Include images of the neighborhood, the garden, and the interior. Place this board somewhere visible. It will remind you why you are saving.

Use a table to track your progress:

| Milestone | Amount Saved |

|---|---|

| First $1,000 | $1,000 |

| First $5,000 | $5,000 |

| First $10,000 | $10,000 |

Review your progress regularly. This keeps your goal in focus and boosts your confidence.

Credit: www.members1st.org

Frequently Asked Questions

How Much Money Should You Save For A Down Payment On A House?

Save at least 20% of the home’s purchase price for a down payment. This helps avoid private mortgage insurance.

How Long Does It Take To Save For A Down Payment On A House?

Saving for a down payment on a house typically takes 3 to 5 years. Factors include income, expenses, and savings rate.

How To Save 20% Down Payment For A House?

Save 20% down payment by budgeting, cutting expenses, automating savings, increasing income, and using windfalls like bonuses.

Is $10,000 A Good Down Payment For A House?

A $10,000 down payment can be good for first-time buyers, but it depends on home prices and loan terms.

Conclusion

Saving for a down payment on a house is achievable with careful planning and discipline. By setting realistic goals and budgeting wisely, you can reach your target. Stay committed to your financial plan and make adjustments as needed. Remember, every little bit saved brings you closer to owning your dream home.

Happy saving!