To create a monthly budget from scratch, list your income and expenses, then allocate funds accordingly. Track spending to adjust as needed.

Creating a monthly budget can transform your financial health. Knowing where your money goes enables you to make informed decisions and achieve your financial goals. Start by listing all sources of income, including salaries, freelance work, and passive income. Next, itemize your expenses, categorizing them into essentials and non-essentials.

Allocate funds to each category based on priority. Regularly track your spending to ensure you stay within your budget. This proactive approach helps in identifying areas where you can cut costs and save more. Following these steps can lead to better financial stability and peace of mind.

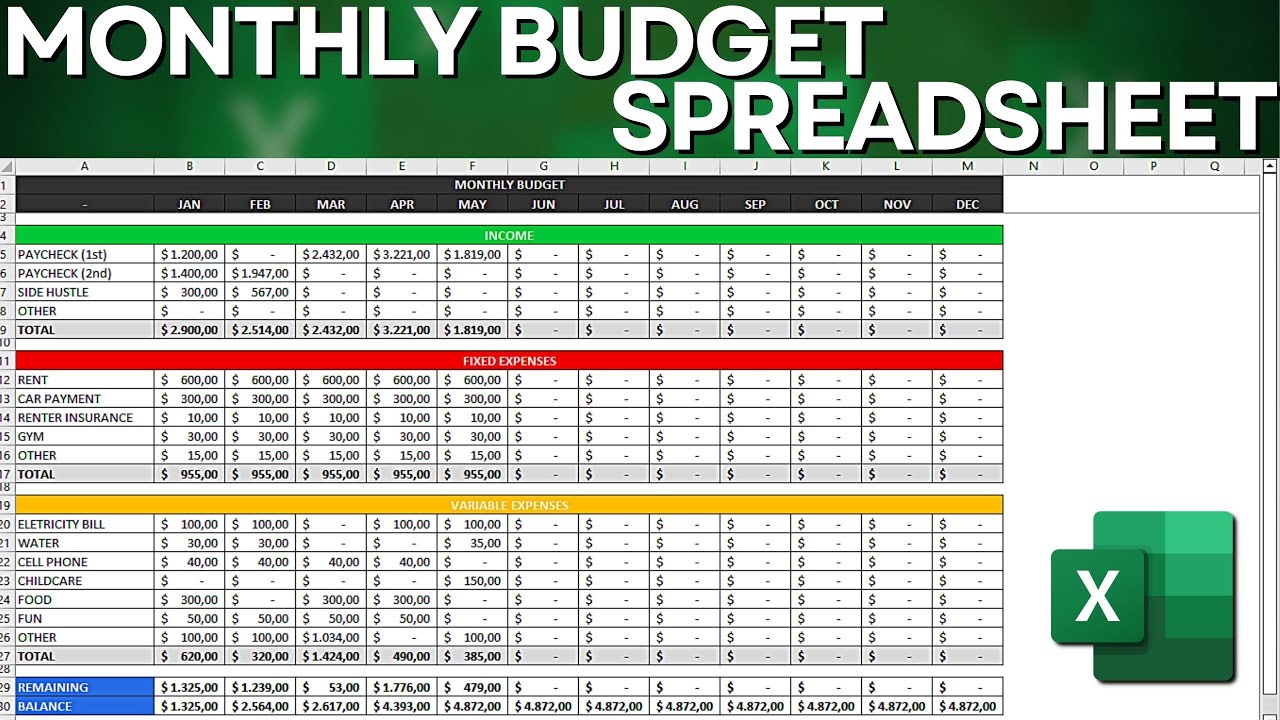

Credit: m.youtube.com

Importance Of Budgeting

Creating a monthly budget from scratch is essential. It helps you manage your finances effectively. Budgeting ensures you have control over your money. Below, we explore the importance of budgeting.

Financial Stability

Budgeting is crucial for achieving financial stability. It allows you to track your income and expenses. This way, you know exactly where your money goes. A budget helps prevent overspending and ensures you live within your means.

Consider the following table showing a simple budget plan:

| Category | Amount |

|---|---|

| Income | $3,000 |

| Rent | $1,000 |

| Groceries | $300 |

| Utilities | $200 |

| Transportation | $150 |

| Entertainment | $100 |

| Savings | $500 |

By following a budget like this, you ensure you have money for essential needs. It also lets you save for unexpected expenses.

Goal Achievement

Budgeting is key to achieving your goals. Whether saving for a vacation or a new car, a budget helps. It gives you a clear plan to reach your financial goals.

Here are steps to set financial goals with a budget:

- Identify your goals.

- Determine the cost of each goal.

- Set a timeline for achieving each goal.

- Allocate a portion of your income to each goal.

By following these steps, you can systematically save money. This makes your goals more attainable.

Budgeting also helps you prioritize your spending. You can focus on what truly matters to you. This ensures you reach your financial milestones.

In summary, budgeting is vital for financial stability and goal achievement. It gives you control over your finances and helps you achieve your dreams.

Assess Your Income

Before creating a monthly budget, you need to assess your income. Knowing how much money you earn helps you plan better. This step is crucial for accurate budgeting.

Total Monthly Income

Start by calculating your total monthly income. This includes your salary, wages, and any other regular payments. Make a list of all sources of income:

- Salary

- Wages

- Bonuses

- Rental income

Use a simple table to track your income:

| Income Source | Amount |

|---|---|

| Salary | $3000 |

| Rental Income | $500 |

Add up these amounts to find your total monthly income. This number is the foundation of your budget.

Variable Income Sources

Next, consider any variable income sources. These are earnings that change each month. Examples include:

- Freelance work

- Overtime pay

- Seasonal jobs

- Side gigs

List all variable incomes and estimate their average monthly amount. Use another table to organize this:

| Variable Income Source | Average Monthly Amount |

|---|---|

| Freelance Work | $400 |

| Side Gigs | $200 |

Combining your total and variable incomes gives you a clear picture. This helps in planning your budget effectively.

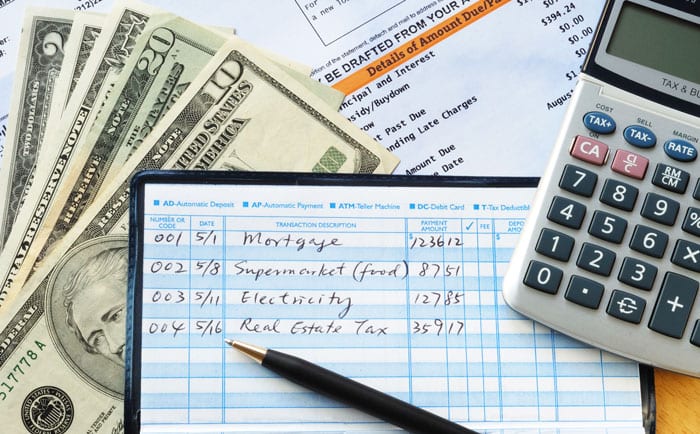

Track Your Expenses

Tracking your expenses is the first step to creating a monthly budget. It helps you understand where your money goes. This step is crucial for building a strong financial foundation.

Fixed Expenses

Fixed expenses are bills that stay the same each month. Examples include:

- Rent or mortgage payments

- Car payments

- Insurance premiums

- Internet and cable bills

Create a list of all your fixed expenses. Use a table to organize your data:

| Expense | Amount |

|---|---|

| Rent | $1,200 |

| Car Payment | $300 |

| Insurance | $150 |

| Internet | $60 |

Variable Expenses

Variable expenses change each month. These include things like:

- Groceries

- Gasoline

- Entertainment

- Dining out

Track your variable expenses for a month. Use a table to record them:

| Expense | Amount |

|---|---|

| Groceries | $400 |

| Gasoline | $100 |

| Entertainment | $80 |

| Dining out | $120 |

By separating your expenses into fixed and variable categories, you can better manage your budget. This helps you see where you can cut costs if needed.

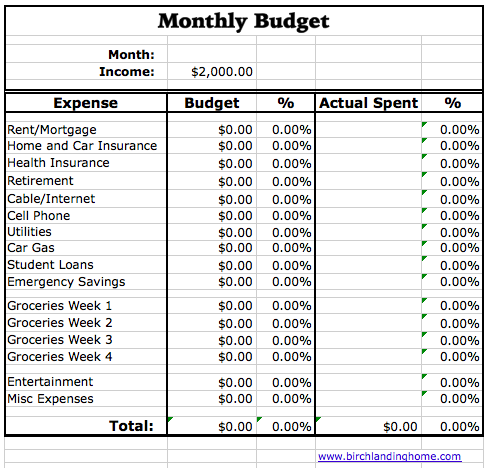

Credit: www.birchlandinghome.com

Categorize Your Spending

To create a monthly budget, you must categorize your spending. This helps track where your money goes. It also reveals areas for potential savings. Let’s dive into how to categorize your spending efficiently.

Essential Vs Non-essential

First, divide your expenses into essential and non-essential. Essential expenses are things you need to live. These include:

- Rent or mortgage payments

- Utilities like water, electricity, and gas

- Groceries and basic food items

- Transportation costs, such as gas or public transit

- Insurance payments

Non-essential expenses are things you can live without. Examples of these include:

- Dining out

- Entertainment and hobbies

- Subscription services like Netflix or Spotify

- Clothing beyond your basic needs

- Luxury items and gadgets

Discretionary Spending

Discretionary spending covers non-essential expenses that you choose to spend money on. It includes:

- Vacations and travel

- Gifts and donations

- Beauty and grooming services

- Fitness memberships

- Electronics and gadgets

To manage your budget well, keep track of these expenses. Use a table to organize your discretionary spending:

| Category | Monthly Amount |

|---|---|

| Vacations and Travel | $200 |

| Gifts and Donations | $50 |

| Beauty and Grooming | $75 |

| Fitness Memberships | $40 |

| Electronics and Gadgets | $100 |

By categorizing your spending, you gain control over your finances. This allows you to make informed decisions about your money.

Set Financial Goals

Setting financial goals helps you manage your money. It gives you direction. You need to set both short-term and long-term goals. This will keep you motivated and on track. Below, we will discuss two types of goals.

Short-term Goals

Short-term goals are things you want to achieve soon. These goals are usually within a year. Here are some examples:

- Save $500 for an emergency fund.

- Pay off a small credit card debt.

- Save for a new phone.

Setting short-term goals helps you build confidence. You can see results quickly. This keeps you motivated to stick to your budget.

Long-term Goals

Long-term goals take more time to achieve. They usually take more than a year. Here are some examples:

- Save for a house down payment.

- Plan for retirement.

- Save for your child’s college fund.

Setting long-term goals is crucial for your future. These goals require more planning and discipline. They help you stay focused on the bigger picture.

Both short-term and long-term goals are essential. They guide your budgeting efforts. Start with small steps and build towards bigger achievements.

Credit: www.incharge.org

Create The Budget

Creating a monthly budget helps manage your money well. It’s important to allocate funds wisely. Balancing income and expenses is key. This guide will help you create a budget from scratch.

Allocating Funds

Start by listing your income sources. These can be your salary, freelance work, or side jobs. Write down the total amount of money you earn in a month.

Next, list your expenses. Break them into categories like:

- Housing: Rent or mortgage, utilities.

- Food: Groceries, dining out.

- Transportation: Gas, public transport, car maintenance.

- Entertainment: Movies, subscriptions, hobbies.

- Healthcare: Insurance, medications, doctor visits.

Allocate funds to each category. Make sure your needs are covered first. Allocate remaining funds to wants and savings.

Balancing Income And Expenses

Compare your total income to your total expenses. Use a simple table to visualize this:

| Category | Monthly Amount |

|---|---|

| Total Income | $3000 |

| Total Expenses | $2500 |

| Difference | $500 |

If your expenses exceed your income, find areas to cut back. If you have extra money, consider increasing your savings. Always aim to balance your income and expenses.

Review your budget every month. Make adjustments as needed. This helps you stay on track and meet your financial goals.

Implement And Adjust

Now that you’ve created your monthly budget, it’s time to put it into action. Implementing your budget means sticking to your plan, and adjusting when necessary. This is where your budget becomes a living document, adapting to your financial life.

Monitoring Progress

Monitoring your progress is essential to stay on track. Regularly check your spending against your budget. This helps identify areas where you might be overspending or saving more than expected.

- Track expenses daily or weekly.

- Use budgeting apps or spreadsheets.

- Compare actual spending with planned budget.

Keeping an eye on your spending ensures you are following your budget. This also helps to spot problems early and make necessary changes.

Making Adjustments

Budgets need to be flexible. Life changes, and so should your budget. If you overspend in one category, adjust another to stay balanced.

- Review your budget monthly.

- Identify categories that need changes.

- Adjust spending limits as needed.

It’s important to be realistic and honest with yourself. Make adjustments that reflect your current financial situation. This helps your budget work better for you.

Here is a simple table to help you adjust your budget:

| Category | Planned Amount | Actual Amount | Difference |

|---|---|---|---|

| Groceries | $300 | $350 | – $50 |

| Entertainment | $100 | $80 | + $20 |

This table helps you see where adjustments are needed. Regular adjustments keep your budget relevant and effective.

Tools And Resources

Creating a monthly budget can be easy with the right tools and resources. These tools help track spending and manage finances. Here are some essential tools to consider.

Budgeting Apps

Budgeting apps are powerful tools for managing money. They simplify tracking expenses and income. Here are some popular options:

- Mint: Syncs with bank accounts and tracks spending automatically.

- YNAB (You Need a Budget): Focuses on proactive budgeting to save money.

- Personal Capital: Offers investment tracking along with budgeting features.

These apps provide real-time updates and reminders. They also offer insights into spending habits.

Financial Advisors

A financial advisor can offer personalized guidance. They help create a budget tailored to your needs. Here’s how they can assist:

- Personalized Plans: Advisors create custom budgeting plans.

- Expert Advice: They offer insights based on financial goals.

- Accountability: Regular check-ins keep you on track.

Financial advisors can be especially helpful for complex financial situations.

Frequently Asked Questions

How To Create A Monthly Budget For Beginners?

To create a monthly budget, list income and expenses. Categorize spending, set savings goals, and track expenses. Adjust as needed.

What Is The 50 30 20 Budget Rule?

The 50 30 20 budget rule allocates income into three categories: 50% for needs, 30% for wants, and 20% for savings.

How Do You Draw Up A Monthly Budget?

To draw up a monthly budget, list all income sources. Identify fixed and variable expenses. Allocate funds for savings. Track spending regularly. Adjust as needed to stay on track.

How To Budget $5000 A Month?

Create a budget by categorizing expenses. Allocate funds to essentials, savings, and discretionary spending. Track and adjust monthly.

Conclusion

Creating a monthly budget from scratch can empower you to take control of your finances. With the right steps, you can manage expenses, save money, and achieve financial goals. Start today and watch your financial health improve. Consistent budgeting leads to financial stability and peace of mind.

Happy budgeting!